March 29, 2016 · David Dixon

Why the Business Aviation Industry Should Take a Long-Term View of Asia-Pacific for Growth

Written by David Dixon, President, Jetcraft Asia

[email protected]

The Asia-Pacific region, though currently tempered somewhat by China’s economic challenges, should not be discounted by the business aviation industry. Where China dominated attention in years past, focus today takes into account growth more broadly, encompassing nations such as the Philippines, Thailand, Indonesia, Malaysia and Singapore.

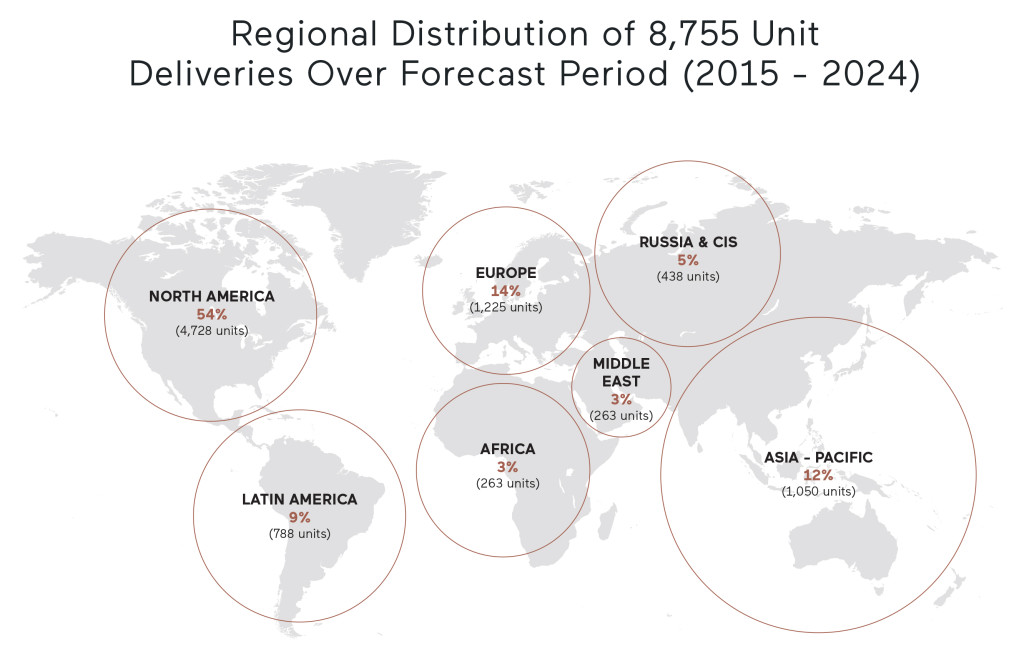

Today, Asian business leaders and many governments are realizing the benefits that business aircraft can offer in terms of stimulating their economies and contributing to long-term regional growth. Jetcraft’s 10-year Market Outlook report projects that Asia-Pacific will account for 12% of the business aircraft deliveries total worldwide through 2024, representing 1,050 units.

Today, Asian business leaders and many governments are realizing the benefits that business aircraft can offer in terms of stimulating their economies and contributing to long-term regional growth. Jetcraft’s 10-year Market Outlook report projects that Asia-Pacific will account for 12% of the business aircraft deliveries total worldwide through 2024, representing 1,050 units.

Indeed, this is the time of year when much attention across our industry turns to Asia. Key tradeshows and exhibitions are underway, such as the Singapore Airshow that occurred last month, and the upcoming annual ABACE 2016 event taking place in Shanghai next month.

At the Singapore Airshow, there was much discussion on the slowing Chinese demand for business jets, as our industry continues to watch its economic recovery. In addition, discussions surrounding the impact of regional business expansions happening outside of major Asian cities in countries like the Philippines and Indonesia, and how such economic developments are prime for private jet travel also took place, as many of these new business destinations are not accessible by commercial airlines.

China’s future impact, the growing importance of other Asia-Pacific countries to the business aviation sector and regulatory hurdles undoubtedly will be discussion points as the industry gears up for ABACE 2016.

Key Countries of Interest

So what is the current state of the region for business aviation growth? We are seeing strong demand in key business aviation hubs such as Japan, Malaysia, Indonesia and Singapore, all the while keeping an eye on the strength of the US dollar to these countries’ currencies. Overall high net-worth growth, geography and location are the primary drivers for business aviation growth in Australia, Indonesia, the Philippines and Malaysia. Although selling environments like Japan and Singapore continue to show interest, as the region’s economies grow, this will continue to attract an inward investment that can boost the growth potential for business aviation overall.

The hope is that some of the more prominent South East Asian economies such as Singapore, Indonesia, Malaysia or Thailand (all of which have customers with long track records in business aviation) can, in part at least fill the vacuum for business aircraft transactions until China’s economy stabilizes.

China Remains Important

Despite its slow economic recovery, business aviation activity is still occurring in China. It is important to note that several financing structures continue to be executed, such as operating as well as traditional finance leases. We are also seeing in markets like Greater China (Hong Kong, Macau, Taiwan) a wave of first-time sellers upgrade from their initial aircraft to some of the new types available today. Lastly, China’s foreign investments are also fueling some growth for our industry. Chinese interests continue to grow in Africa, for example, with investments in the continent’s mining and agriculture sectors. One of the most efficient ways for these Chinese investors to travel to southern Africa is via a private jet.

Overcoming Regulatory Hurdles

The Asia-Pacific region is highly diverse with multiple governments and Civil Aviation authorities. Some of the main areas of regulatory focus, for example, remain on airport expansions, airfield access and aircraft maintenance. The authorities in Asia-Pacific should foster stronger engagement on key international policy and regulatory issues, with a more collaborative approach between regulators and industry stakeholders to ensure continued growth throughout the region. Sadly, the real value of business aviation—employment and national economic growth — to the region’s economy is often overlooked when establishing regulations.

2016 and Beyond

In all, Asia-Pacific does remain a dynamic region for the business aviation sector.

There are about 800 aircraft in the region today and more on order. Time will tell how quickly and how bullishly the region will usher in a resurgence of growth. Regardless, Asia-Pacific represents a strong market for the international business aviation sector today, and will continue for the foreseeable future.

SIGN UP FOR OUR MONTHLY JETSTREAM RECAP

Don't miss future Jetstream articles. Sign up for our Jetcraft News mailing list to receive a monthly eblast with links to our latest articles. Click to join the 1,800+ subscribers on our mailing list.