How findings from our 10-year market forecast reflect real-world trends in the private jet market

This year’s NBAA-BACE trade show in Orlando was marked by an industry-wide feeling of confidence.

The show coincided with our fourth annual 10-year business aviation market forecast, which reaffirms the optimism felt by show exhibitors and attendees. According to the forecast, steady growth in the private jet industry is set to continue, with 8,736 unit deliveries representing $271 billion in revenues (based on 2018 pricing) anticipated over the next 10 years.

Now that we’ve successfully navigated through our industry’s most difficult period, OEMs are again using trade shows to make a statement about their place in the industry. In Orlando, Embraer took early news headlines with the announcement of two new aircraft, the Praetor 500 and 600, both of which made their world debut on the hot tarmac of the static display.

The Praetor 500 and 600 – in the midsize and super midsize segments respectively – are based on Embraer’s previous Legacy 450 and 500, though the range of both aircraft show a significant improvement on the Legacy models, with the Praetor 500 expected to reach 3,740 miles and the 600 managing 4,500 miles.

More major news came from Textron Aviation, which announced an extension of its partnership with NetJets, with options on 325 Citation Longitudes and Hemispheres. As the Hemisphere launch customer, NetJets is having a hand in its clean-sheet design, ensuring the aircraft is optimised for the operator’s needs when it comes to market. However, we’re still awaiting a firm date for the aircraft’s launch, given the ongoing issues with its Safran Silvercrest engine development.

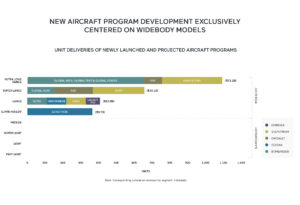

These announcements fit into our evaluation of 20 new aircraft models to enter the market over the next ten years, all of which are super midsize and up. But while the spotlight was focused on midsize, super midsize and large aircraft at the show, we forecast that the Large Jet category – comprising super large, ultra long range and converted airliner models – will account for the highest proportion of revenues.

This category includes Bombardier’s Global 5500, 6500 and 7500, as well as Gulfstream’s G500 and G600. Overall, we’re forecasting that 32% of total units (2,778) and 64% of total revenue will be attributed to models classified as Large Jets. Growth in the segment can be directly attributed to today’s global business environment – customers are buying aircraft that support their needs, which, increasingly, means larger, longer-range models.

With higher unit deliveries, expanding revenues and steady, healthy growth ahead, the launch and entry into service of these (and additional as-yet-unannounced) jets will certainly spell significant change for the widebody market.

SIGN UP FOR OUR MONTHLY JETSTREAM RECAP

Don't miss future Jetstream articles. Sign up for our Jetcraft News mailing list to receive a monthly eblast with links to our latest articles. Click to join the 1,800+ subscribers on our mailing list.